With a growing number of unicorns and strong research universities, Europe is in a position to create several innovation superclusters.

In the past decade, Europe has built a host of frontier tech hubs, and it also sits on strong fundamentals – leading research universities, a shared value system, engaged policymakers, embedded transport infrastructure and hungry talent, according to Saul Klein, founder of LocalGlobe and adviser to the UK government on its Council for Science and Technology. He said: “It is time for Europe to build New Palo Alto.”

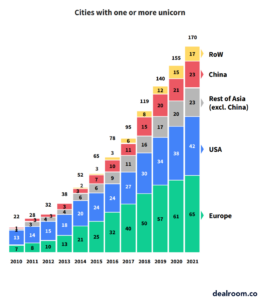

Europe now has more cities that have produced multiple unicorn — $1bn+ valuation — companies.

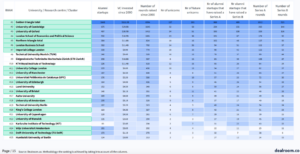

Looking at which universities have created the largest clusters of successful startups give some indication of where this New Palo Alto be located.

Effectively this New Palo Alto would be a supercluster linking London as Europe’s number one tech and venture capital hub with the rest of the country and its French and Benelux peers, including Paris and Amsterdam.

A similar four-or-so-hour train ride would place a second supercluster in Europe around Munich to link Berlin, Milan, Vienna and the Swiss cantons, while Stockholm acts as the regional heart of the Nordics.

Superclusters for new tech

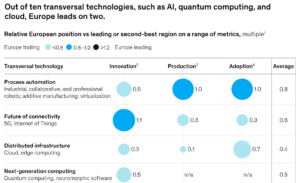

The focus on superclusters by improving transportation, research and funding links – hampered in New Palo Alto by the UK leaving the European Union (EU) last year – is becoming more important as technology is now permeating all sectors via transversal technologies, such as artificial intelligence (AI), the biotech revolution, and the cloud for data storage, undermining prior sectors of specialization and competitive advantage, including chemicals, materials and fashion.

Management consultants McKinsey said: “To give just a few examples, in quantum computing, 50% of the top 10 major tech companies investing in this transversal technology are in the US, 40% in China, and none in in the EU.

“In 5G, a key element of the future of connectivity, China captures nearly 60% of external funding, with the US at 27% and Europe at 11%. In AI, the US captured 40% of external funding in 2015–20.”

Corporations, with their mandates to invest in strategically important startups — rather than just for financial returns — have the potential to be the patient capital these companies need.

“Entrepreneurs want to know investors are there for the long term and corporates should be able to be there for longer than others. That is the great unlock we need, for corporates to be the most patient investors on the cap table,” Klein said at the GCV Symposium in May.

Klein has been advising the UK government though Lord Browne and Sir Patrick Vallance’s council on how engage corporate investors and review measures to support corporate venturing in areas of national priority. The advisers to the council said there was a significant opportunity for the UK to incentivise scale-up investment from corporates, including global R&D businesses based in the UK.